U.Ozel.Images/E+ by way of Getty Images

Although different firms are poised to have GLP-1 receptor agonist medicine for weight loss authorized, they don’t seem to be seemingly to make a lot of a dent in the dominance of Eli Lilly (NYSE:LLY) and Novo Nordisk (NVO) who management the market now.

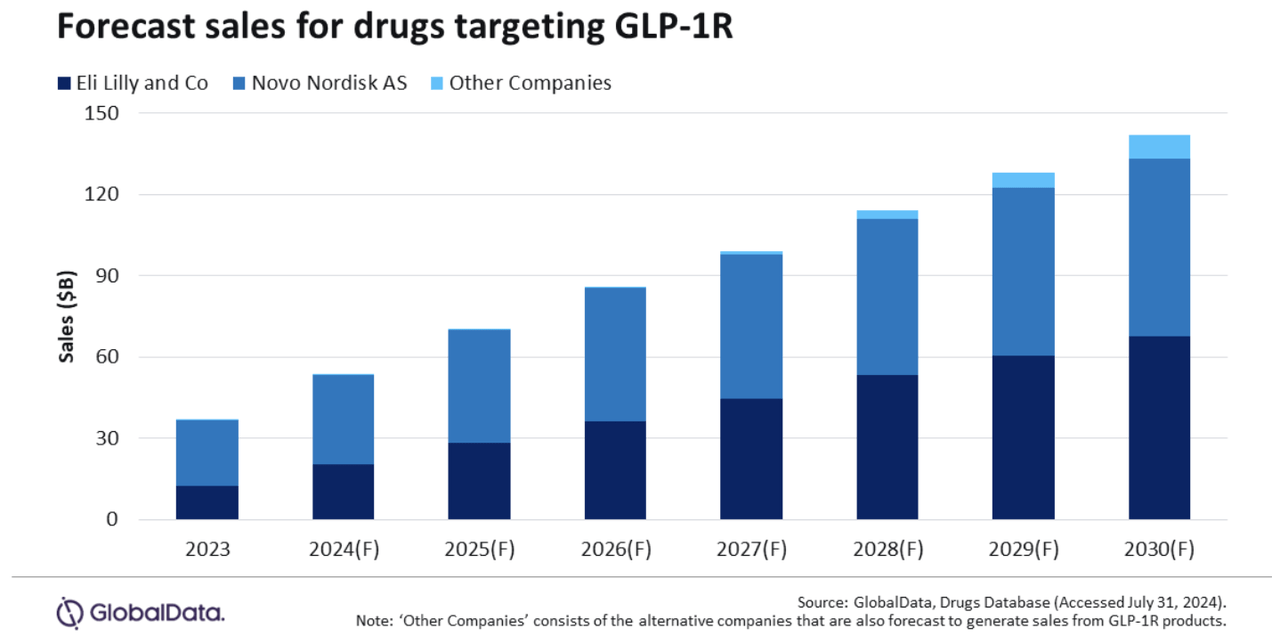

In 2023, the 2 firms accounted for 99% of all GLP-1R agonist gross sales. By 2030, that determine is barely projected to decline to 94% regardless of the seemingly entry of comparable medicines, in accordance to GlobalData.

The class introduced in $37.2B in gross sales in 2023, the information and analytics firm famous.

Novo markets Ozempic and Wegovy (each semaglutide) for, respectively, kind 2 diabetes and weight loss, whereas Lilly’s primary GLP-1Rs are Mounjaro and Zepbound (each tirzepatide) for, respectively, diabetes and weight loss.

By 2030, GlobalData initiatives that 14 different firms can be advertising GLP-1Rs. However, these firms are anticipated to deliver in solely $8.8B in income, a determine “15 instances lower than the mixed valuation of the 2 main firms,” says GlobalData Pharma Analyst Jasper Morley.

GlobalData’s evaluation mirrors that given in June by J.P. Morgan’s Holly Morris and Cantor Fitzgerald’s Louise Chen who spoke on the Seeking Alpha Investment Summit on the weight loss medicine market. Morris stated that each firms’ dimension and getting to market first have seemingly cemented their management of the house, whereas Chen famous that differentiation can be key for any new entrants in the market.

Lilly (LLY) and Novo (NVO) even have their very own superior GLP-1R medicine in the pipeline. For the previous, it has the oral capsule orforglipron and the GIP/GLP-1/glucagon receptor agonist retatrutide in section 3, in addition to three different weight problems medicine in section 2. Novo has CagriSema, a mixture of semaglutide and the amylin analogue cagrilintide in addition to an oral model of semaglutide to be taken day by day. The Danish firm additionally has three different weight loss medicine in section 2.

One of probably the most eagerly anticipated new weight problems medicine to doubtlessly come to market that isn’t from Lilly or Novo is Amgen’s (AMGN) MariTide, which is each a GLP-1R agonist and a GIPR agonist. It is at the moment in section 2 for diabetes and weight loss.

However, that candidate is anticipated to generate solely $3B in gross sales in 2030, in accordance to GlobalData.

Other candidates to look out for embody Viking Therapeutics’ (VKTX) section 2 VK2735, which Seeking Alpha analyst Stephen Ayers just lately gave a bullish evaluation of. An oral model of the candidate is in section 1. Roche (OTCQX:RHHBY) has three candidates in section 1 improvement: a GLP-1R agonist, a twin GLP-1 /GIP receptor agonist (similar mechanism of motion as Mounjaro and Zepbound), and an anti-latent myostatin.

In addition, Zealand Pharma (OTCPK:ZLDPF) and Boehringer Ingelheim are creating survodutide whereas Altimmune’s (ALT) pemvidutide.

More on Eli Lilly, Novo Nordisk

Source: Seekingalpha